Study Of Water And Wastewater Manufacturers' Content Released

By Bill King

B2BrandWater just completed its annual study of content produced by water and wastewater manufacturers. The study reviewed the content production of 74 manufacturers, analyzing 6,484 pieces of content. It’s the only study we’re aware of that specifically analyzes the content being produced by equipment manufacturers for water and wastewater treatment and distribution audiences.

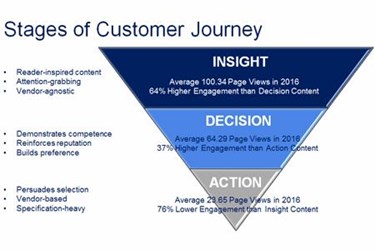

Each type of content was mapped into one of three content stages. You may have seen customer lifecycle diagrams, most often depicted as sales funnels. At the top of the funnel is INSIGHT content. This type of content is typically vendor-agnostic, designed to grab attention, generate leads and is heavily focused on the information needs of readers.

The middle of the funnel features DECISION content. This content serves the purpose of building a vendor preference in the reader, reinforcing vendor reputation and demonstrating competence. Case studies are great examples of decision content.

At the tip of the funnel is ACTION content. This content is all vendor-based. It’s designed to persuade the reader to select the manufacturer’s product by providing product detail and specifications.

The study shows that reader-centered Insight content has a 64% higher engagement rate than the more preference-building Decision content. And in turn, Decision content is 37% more engaging with readers than the specification-heavy Action content.

Interestingly, when mapped to the three content stages, water and wastewater manufacturers’ content is overwhelmingly action-oriented. There were 3,360 (52%) pieces of Action content produced, 2,208 (34%) pieces of Decision content produced and only 916 (14%) pieces of Insight content produced. Put another way, water and wastewater manufacturers’ content output is a complete inversion of the traditional sales funnel.

It’s understandable when you think about the traditional function of marketing. Content is generally created when a new or enhanced product is being introduced and is generally produced at the request of the salesforce, which in the water and wastewater market is often regional sales managers working with networks of independent rep firms.

The study found that the largest category of content produced is product and service announcements at 1,379 pieces of content or 21% of all content. Product datasheets and brochures constitute 12% (781) and 15% (957) of content pieces respectively.

Typically, regional sales managers use product literature to educate their reps on the features and benefits of the new product who in turn want brochures and product literature that they can talk to and hand off to the engineers and operators in their territory. Datasheets are part of the launching process to be available as handouts at a tradeshow.

Similarly, Decision-building PR efforts in the water and wastewater market (often the work of the marketing department) announce new personnel or events on the Company’s timeline. The study found that 15% (955) of content pieces created were news releases. Fourteen percent (883) of content produced are case studies, once again produced as quickly as possible to reinforce new product acceptance in the market, whether as a pilot or following full adoption.

The sparsity of Insight content is both alarming and full of opportunity for the manufacturer brave enough to redirect its traditional marketing approach. There is a huge opportunity for manufacturers to engage far more engineers and operators far earlier in their decision-making process by creating a body of educational content addressing their customers’ challenges and informational needs. It’s a different type of content than what has generally been created to date. But it’s the type of content that will pull more customers into your sales funnel earlier, allowing you time to differentiate your offerings and avoid the end of the process “low bid” RFQ trap.